Introduction

When you are importing anything from China, it is always important to understand a few things such as taxes, VAT, port charges, and customs. However, each country has different standards and requirements regarding the custom value calculation method and import duty rates.

There are a lot of brands that manufacture excavators such as John Deere, Kubota, Hitachi, bobcat, & Komatsu. These brands belong to different countries. Each country has different rules for importing and exporting. Most people trust Chinese brands due to their low prices and high quality as compared to other countries’ brands. If you need help importing your excavators from China, this article can be very helpful for you.

If you are also planning to import your micro excavator from China, then this article will give you a complete guide on Taxes, custom valuation methods, and other import duties. You will be able to know about Importing your goods or small excavators from China to the following countries :

✔United Kingdom

✔New Zealand

✔Australia

✔Canada

✔European Union

✔United States Of America

Before moving forward with all the important guidance related to Importing, it is important to know how different situations may affect importing from China. For example, a recent pandemic of Covid 19 has also impacted the import of goods from China to other countries.

Impact Of Covid 19 Pandemic On Tariffs

As a matter of fact, the pandemic didn’t impose any major impact on taxes or tariffs on imported materials such as compact excavators. In the United States of America, Trump-era tariffs were efficiently maintained on goods imported from China. However, these situations might change in the upcoming future.

On the other hand, tariffs in Australia, the UK, the EU, and other such countries also didn’t go through any major changes. However, the most serious issue that arose for importers is the increase in freight costs.

Are Import Duties and Taxes Affected By Increased Freight Costs?

In some countries, import tariffs, as well as taxes, are calculated based on the freight costs. Particularly in European Union and the United Kingdom, the import duties and taxes are affected by changes in freight costs. The higher the freight costs, the higher will be the import duties in the country.

For example, During the pre covid days,

If your mini excavator costs USD 10,000, the freight cost is USD 2000, and the duty rate becomes 5%. Now when you calculate :

(2000+10000) x 5% = USD 600.

Now, during the Covid 19 Pandemic, the freight cost increased to USD 10,000 for the same previous example. On calculation, the final cost becomes 1000 US dollars. This is how an increase in freight costs increases the import duties as well.

Import Duties For RCEP Countries

RCEP stands for regional comprehensive economic partnership. It is actually a free trade agreement among selected 15 countries in the world. 10 of those countries are from the Southeast Asian region while the other 5 are China, Japan, Australia, New Zealand, and Korea. Importers from these countries can enjoy lesser or zero customs and tariffs. Many RCEP countries lie in the neighborhood of China, therefore, they can be benefited from China’s trade.

Import Duties On Mini Excavators In the USA

When you import any product from China to the international boundaries, you have to pay a particular amount of tax, known as import duties.

When importing from China to the USA, you are charged import duties on your micro excavators with a customs value of $200. This value can also be increased based on different products. For example, In European Union, there is an increase or decrease in taxes on different products especially agricultural products or food products.

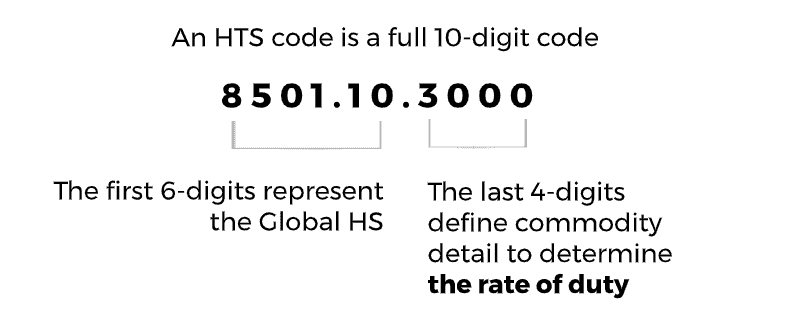

Harmonized Tariff Schedule (HTS)

In most cases, the import duties on products imported from China are 3 to 25 percent. You can also calculate the import duties and taxes by using Harmonized Tariff Schedule. It is actually a document to determine duties across the globe.

Merchandise Processing Fee (MPF)

If you are living in the USA and you have to import your mini excavator from China, then you need to pay a merchandise Processing Fee. It is actually based on the order value. Moreover, MPF is divided into two main categories :

1. The merchandise processing fee for goods having a value less than $2500 will be $2 to $9 per shipment.

2. The merchandise processing fee for goods having a value of more than $2500 is 0.3464% of the value of your imported goods.

You should note that the minimum MPF is $25 while the maximum MPF is $485. It is interesting to note that the merchandise processing fee is a negligible expense especially when you are importing your mini excavator from China.

Harbor Maintenance Fee (HMF)

When you transport your mini excavator or any other good through the sea, you have to pay a harbor maintenance fee. In the late 80s, the harbor maintenance fee was created. The basic intention behind HMF’s creation was to share the maintenance costs of container terminals by importers in the USA. However, you don’t need to worry much about HMF since it is only 0.125% of the value of cargo.

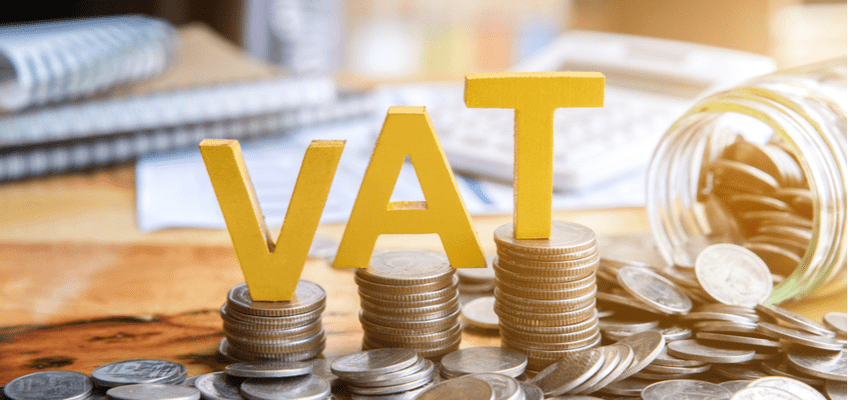

Other Additional Taxes

In some countries, you have to pay VAT while importing your products from China. It is good to know that USA importers don’t have to pay VAT. It is a federal excise tax that you are charged on some Imports. It is not necessary that you have to pay VAT while importing a mini excavator because it is mostly charged on products like tobacco and alcohol.

Customs Value

The MPF, HMF, and custom values are calculated based on the FOB costs of your imported products. FOB stands for Free On Board. This cost may include the following parts :

✔Cost of product

✔Cost of transportation of your mini excavator or any other product

✔Chinese export clearance.

It is important to note that different Chinese suppliers and manufacturers give quotations for their products based on the FOB costs.

Importing Your Mini Excavator From China To the European Union

First of all, it should be clear to you that the EU is a single market. It indicates that the member states of the European Union have similar rates of import duty on products imported from non-European Union countries. If you are importing your mini excavator from China, you have to pay customs only once for the small excavator.

Moreover, you will not be charged import duties that are being sold within the European Union. Hence, the German and Spanish customers will not be paying customs on the mini excavators that have already entered the territory of the European Union.

Import Duties On Products Imported From China To European Union

When you are importing your mini excavator from China to the European Union, the import duty rates may vary. The rates vary from product to product. It is to be noted that those products that aren’t manufactured in the European Union, may have very low rates of import duties. It can be even as low as 0%.

At the same time, there are no import duty rates on products that are manufactured by any important industry in the European Union.

Value Added Tax (VAT)

VAT is considered essential across the European Union. It is interesting to note that different states of the European Union have different rates of Value Added Tax. However, the standard rate of VAT is charged on industrial and consumer products imported from China.

The VAT of your mini excavator is added on top of the customs value. The import duty rates are also added as well that are based on the customs value. As a matter of fact, the value-added tax charged on the imported products is also treated as the value-added tax charged on the products purchased within the European Union. It indicates that the VAT charged on your imported products can be offset against the value-added tax on sales.

Customs Value In European Union

As a matter of fact, the customs value of the European Union is based on the cost insurance freight (CIF) of your imported products. The customs value of the European Union includes the following costs :

✔Insurance price

✔Product cost

✔Development costs of the product

✔Logistics and shipping costs

✔Tooling costs

Here is a list of what costs aren’t included in the customs value :

✔Fee and commission charged for purchasing members

✔Costs of transportation that are generated in the importer’s country

✔Costs and fees charged in the destination port

It should be noted that the customs authorities don’t give rough estimates. The declared costs are written on the Bill of Lading. A Bill of lading is a document that is given by your freight forwarder or the supplier. At this point, your manufacturer will have to declare the correct costs otherwise you may end up paying the incorrect amount.

Import Duties On Products Imported From China To Canada

Canada is one of the major English-speaking countries and its tax situations are quite complex. If you are a Canadian importer, then you have to pay three different types of taxes listed below :

- Provincial Sales Tax (PST)

- Harmonized Sales Tax (HST)

- Goods and Services Tax (GST)

It is to be made clear that one or two taxes usually apply in all the states. No state has to pay all these three taxes. An example of some states is given below :

- Alberta has to pay GST but it doesn’t have to HST and PST.

- Ontario has to pay HST but there is no need to pay GST and PST.

- Prince Edward Island has to pay HST instead of PST and GST. The highest rate on Prince Edward Island is 15%.

The interesting thing about Canada is that it sets very low rates of import duty for underdeveloped countries.

Customs Value In Canada

The customs value of your products in Canada is based on the FOB costs. However, the costs of shipping are usually not included in the customs value. This makes the duty rates very low. Importers from Canada still need to include service costs, product sample costs, and tooling costs in the customs value.

Import Duties On Australia Importers

If you are an Australian, then you have the advantage of paying lower import duty rates as compared to the EU and USA. It is due to the fact that the economy of Australia doesn’t rely on manufacturing industries just like many developed countries.

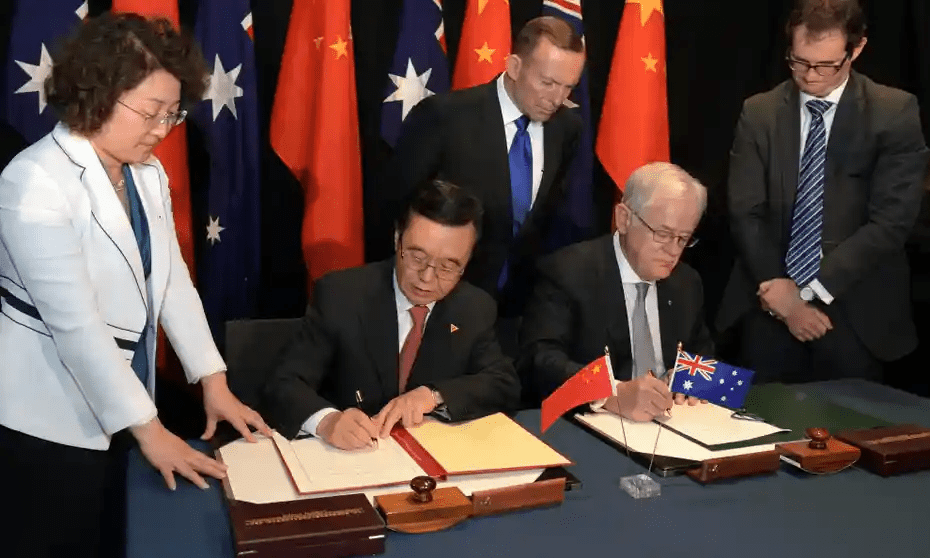

Free Trade Agreement Between China and Australia

This agreement was signed in 2015 regarding the import duties on products being imported from China to Australia. It reduced the duty rates to zero for so many products. According to a report in 2019, it was found that there are 93% of products imported from China to Australia with no Tariffs. However, it is also essential to know that the products imported from China still need to be charged a GST.

There was a situation in Australia when the importers didn’t use to pay GST for products costing less than $1000. However, according to the new laws and rules, the Australian importers need to pay GST for the imported products.

Goods And Services Tax On Products Imported From China

There is a 10% GST charged on imported items in addition to the customs value, insurance, import duty, and transportation. This applies to each and every item imported from China to Australia.

Import Processing Charge Costs

If you are an Australian importer, you may need to pay an import Processing Charge on goods having cost more than $1000. This charge depends upon three main factors listed below:

✔The Transportation Mode

✔Import Declaration Type

✔Customs Value

You have to pay the fee for each declaration of your Imported goods. This indicates that you must have to pay the import processing charge on every shipment from China.

It is interesting to note that the import processing charge lies in the range of AU$40 and AU$50.

Customs Value On Products Imported From China To Australia

You have to be clear that the Import Processing Charge, GST, and the customs value are all based on (the FOB) of your goods. This will contain the following parts:

✔Export clearance

✔Costs of Transportation

✔Costs of Product

Import Duties In the United Kingdom

The UK is in line with the European Union system indicating that :

✔If you are a UK importer, you have to pay import duties on most products imported from China to Australia.

✔You need to pay VAT for your products.

✔The customs value of your products is calculated based on insurance, freight costs, and product costs.

✔There is a prediction that the VAT rules and tariffs may deviate from the European Union in the future.

The Anti-dumping duties

According to research, the government of China has provided subsidies to certain industries and manufacturers. It means that some Chinese suppliers and manufacturers can also sell their products at costs lower than the actual costs.

However, these rules of the Chinese government aren’t favored by US and EU resulting in a reaction with Anti-dumping duty measures. The Anti-dumping duties may target individual manufacturers or entire industries.

The Anti-dumping duties lie in the range of 40% to 60% and therefore, these should be taken very seriously. You need to make sure that your imported products are under Anti-dumping duties or not. Otherwise, you may not be notified until your product reaches its destination. The Chinese manufacturers aren’t responsible for the rules of taxation outside Chinese boundaries.

Declared Value

All the taxes, as well as import duties, are calculated in the form of percentages on the basis of customer value. On the other hand, the customs value is calculated on the basis of the declared value. This, in turn, is stated on your commercial invoice of the product. A commercial invoice is a document given by your manufacturer or supplier. You should make sure that there is a correct value written on the commercial invoice otherwise you will end up paying an incorrect amount.

Note that the liability of correctness of commercial invoice is given to the importer. A Chinese manufacturer or supplier cannot take this responsibility.

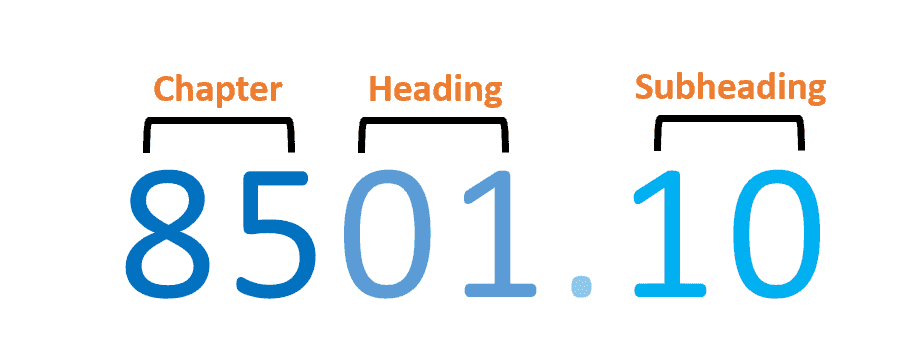

HS Codes

The HS codes of your Imported products or mini excavators are another most important thing to consider. The declared value isn’t the only thing upon which your import duty depends. The import duty varies based on different factors.

When you import a product or a small excavator from China, you get an HS code to classify your product. The customs officers don’t have a lot of free time to check each and every carton. However, the HS codes can make the process simpler by saving time for custom officers.

Again, it is your responsibility to make sure that the HS code is also given in your commercial invoice. Otherwise, you will be charged the wrong import duty rate on the basis of an incorrect product.

Payment Of Taxes And Import Duties

When you import a compact excavator from China, there are a lot of ways to pay taxes and import duties. You can pay these amounts to your manufacturer or supplier as well. Here are some most common causes listed below:

1. You can pay the import duty rates to your freight forwarder.

This method is considered the simplest of all. Once your product arrives at the destination, the customs officers will charge taxes and customs on the basis of declared Value as well as HS codes. An invoice is generated and then delivered to you by your shipping agent.

There may also be the case that you need to pay all the charged amount or taxes before the delivery of your product. Your shipping management may charge you in a range of $40 to $80 for taking care of your customs declaration.

2. You can pay taxes by applying for customs credit.

You can do it through your local customs authorities. They can offer you custom credits if you are an importer. Basically, the purpose of this method is to get your products delivered first and pay the taxes at a later date.

3. You can also buy a Delivery Duty Paid (DDP) directly from your manufacturer or supplier.

A DDP is an agreement between a seller and purchaser that sets the most responsibility to the seller. It includes custom duties. Moreover, when you pay the price to your supplier, it will also include the import duty rate. However, the problem with this method is that it doesn’t include GST and VAT due to cross-border issues. All those taxes need to be paid when your product arrives at the port of destination.

Import Duties Are Refundable Or Not?

Import duty rates aren’t refunded to the importer. You may get a refund of VAT rates but not import duty rates. Therefore, you should consider it as a part of purchasing cost of your product. In most cases, the import duty rates are very low that they barely make a difference. While in other cases, you may need to pay a huge amount of import duty. It is not a temporary outlay.

Import Duties On Repaired Attachments Or Replaced Parts

It is very interesting and good news to know that you don’t need to pay for repaired or replaced parts. There may occur a situation when your supplier sends you a replacement of defective parts. Or, you may need to ship your product to China for repair. In both cases, you generally don’t need to pay import duties. However, it is important to notify your customs broker or freight forwarder before the shipment takes place.

Even if you pay them again, you can also get a refund of those import duty costs. Make sure that you have proof showing that the product is replaced or repaired.

Taxes and Import Duties Are Paid In China Or Not?

The simple answer is No. Foreign individuals and companies don’t need to pay taxes in China. It is because any kind of costs charged in China will be added to FOB costs.

If you buy any product from your Chinese supplier through Ex-work terms, there will be exporting or shipping costs included. This means that you will be charged for transportation of your product from your supplier’s factory to the loading destination. Most people can’t even afford this payment. Therefore, experts recommend buying your products at FOB terms. Since buying at EXW terms can be very costly for you.

Reduction Of Taxes And Import Duties When Buying From China

If you understand the custom value, there is no difficulty to reduce the taxes and import duties. It is because the whole amount is calculated on the basis of declared custom value. However, this practice is quite risky and you can even go to jail for such illegal practices.

The import duties on your products are reduced in some countries by exploiting the trade agreements between different countries. At the same time, the transportation costs are loss-making for medium and small-sized importer businesses.

Who Is Liable For Payment Of Taxes And Import Duties When Your Product Is Drop shipped?

The receiver of the products is the importer who ordered the product from China. When your product is drop shipped from China to your location, you will receive a parcel from your supplier. Therefore, you as an importer and customer will be paying import duties, taxes, VAT, GST, etc.

Golden Knowledge Points To Consider When Importing From China

Importing your mini excavators or any other machinery from China may seem a very simple task. However, everything can turn out to be a mess if you don’t know some basic knowledge points about importing from China. This part of the blog is going to highlight all the important things that you should consider while importing from China.

✔You should make sure that the products are allowed to be legally imported from China. It is due to the fact that some products in China contain special rules. If you don’t know whether your product can be legally imported or not, you can also contact your customs broker. A professional custom broker will always help you in this situation.

✔Make sure that you take the responsibility for shipping costs or do some management regarding it. It totally depends on the intercoms that you are following. You may or may not be responsible for the shipping costs as well as other assumed risks. Sometimes the responsibility goes to the seller for taking care of shipping costs. In this situation, you should keep in touch with your seller. Your shipping costs may include costs such as courier service, international postal service, air freight, or ocean freight depending on the size, weight, and type of your product.

✔Make sure that the information about a product is clear and valid. Not having enough details about your imported products may create a mess for you. Moreover, it is illegal to provide inaccurate value and information about your products.

✔Make sure that you are following the correct customs procedures. At this point, a professional customs broker will help you follow the procedures. When you are buying an excavator to dig, landscape, or clean the snow, It is as important to choose the right customs broker as choosing the right supplier.

✔To save your product from any kind of loss, make sure that you got the insurance for your digging excavator. Product liability insurance is a great way to get your product safely. When you are importing your mini excavator from China, an insurance professional can help you get product liability insurance. Especially, when you are importing heavy hydraulic equipment, there are more chances of destruction. Therefore, you should have product liability insurance.

✔Make sure that you have the right custom bonds. Basically, there are two main types of customs bonds available in the market. It is your duty to ensure that you got the right one. Each of them has its own characteristics when you compare them. If you want to make the import process simpler, you should get a continuous bond. If you have any confusion, you can consult your licensed customs broker to get you the right custom bonds for your machine.

Additionally, you can always contact us for more information.